Customer Acquisition Cost (CAC) is a crucial metric for businesses to measure and understand. It represents the amount of money a company spends to acquire a new customer and can have a significant impact on the overall success of a business. In this piece, we’ll learn how to reduce the cost of acquiring customers in 2023.

Customer Acquisition Cost, or CAC, is a term used to describe the total expenses a business incurs in order to acquire a new customer. This includes marketing costs such as advertising and promotions, as well as sales costs such as salaries and commissions for sales team members. By understanding CAC, businesses can determine the cost of acquiring new customers and assess the effectiveness and efficiency of their marketing and sales efforts.

Knowing CAC is important for businesses, as it helps them make informed decisions about where to allocate resources, how much to spend on acquiring new customers, and how to measure the return on investment from these efforts. Additionally, comparing CAC to the lifetime value of a customer can provide insight into the potential profitability of acquiring new customers. By monitoring and managing CAC, businesses can maximise their profits and achieve their growth goals in 2023 and beyond.

To calculate Customer Acquisition Cost (CAC), follow these steps:

- Determine total marketing and sales expenses: This includes all expenses incurred in acquiring new customers, such as advertising costs, salaries for sales and marketing personnel, and any commissions or bonuses paid to sales representatives.

- Divide the total expenses by the number of new customers: This gives you an average cost per customer.

- Factor in the time period: CAC can be calculated for a specific period, such as a quarter or a year. Divide the total expenses by the number of new customers acquired during that period to determine the CAC for that period.

Example: If your company spends $100,000 on marketing and sales expenses and acquires 100 new customers, the CAC would be $1,000 ($100,000/100 customers).

It is important to regularly calculate and monitor CAC in order to identify any trends or patterns, and make changes to your marketing and sales strategies as needed.

Effective methods for lowering your customer acquisition cost.

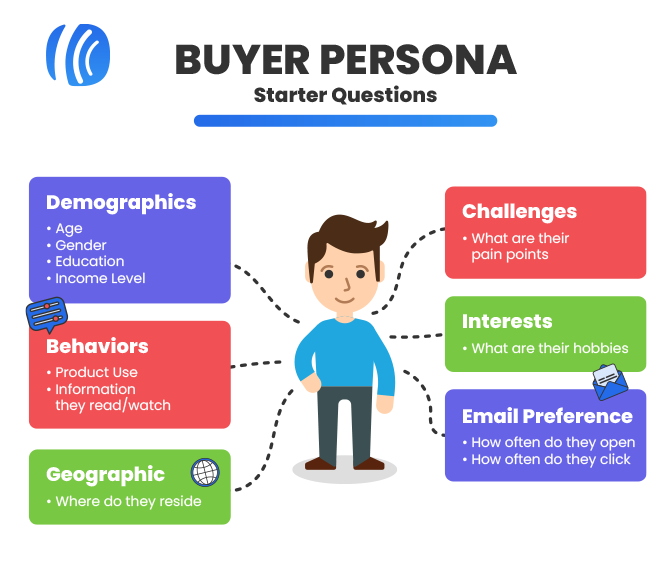

1. Know your customers: Understanding your customers is a critical step in reducing your customer acquisition cost (CAC). High CAC may mean that you are not delivering the right solutions to customers through the most effective channels or at the most opportune times. To gain a better understanding of your customers, create buyer personas. These are fictional representations of your ideal customers based on data, research, and insights. By creating buyer personas, you can get a better sense of what your customers need and want, which will help you make more informed decisions about your marketing and sales strategies. By understanding your customers, you can tailor your solutions and marketing messages to better meet their needs and ultimately lower your CAC.

2. Find your target audience: Identifying the right audience for your marketing efforts is important to effectively reduce CAC. By knowing who your target audience is, you can tailor your marketing messages to resonate with them and create a tone of voice that they can connect with. A target audience analysis will give direction to your marketing initiatives and ensure consistency in your messaging. This will help you build stronger relationships with customers and provide them with the solutions they need, ultimately lowering your CAC.

3. Shorten the sales cycle: A longer sales cycle means more money spent and higher CAC. To reduce costs and increase return on investment, it’s important to shorten the sales process. Marketing automation tools like chatbots can help streamline the process. They can generate up to 25% more leads, score and categorise leads based on predefined metrics, and provide faster responses and follow-ups to speed up the sales cycle.

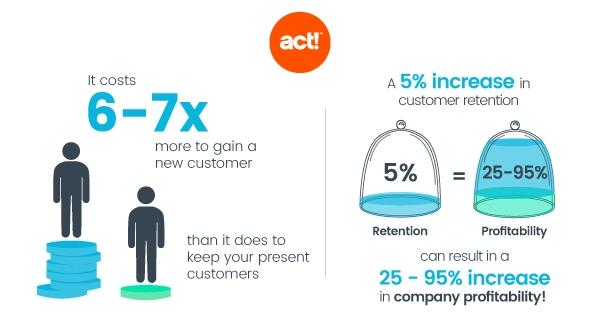

4. Reduce the Churn rate: Reducing customer loss is key to reducing CAC. It costs more to get a new customer than to keep an existing one, so it’s important to keep track of customer churn and take steps to lower it.

Preventing customer churn is key to reducing customer acquisition cost. One effective way of achieving this is by monitoring customer satisfaction regularly. By proactively engaging with your customers and seeking their feedback, you can gain valuable insights into their experiences with your product or service. This information can then be used to optimise your offerings and processes to ensure that your customers are happy and satisfied.

Utilising technology such as chatbots can be a huge help in this regard. Chatbots can gather customer feedback at scale, providing you with a wealth of information about customer behaviour. This can be used to gain a better understanding of your customers, identify pain points and improve their experiences with your brand. By keeping a close eye on customer satisfaction, you can reduce churn and in turn, keep your customer acquisition cost low.

5. Increase the Average Order Value: One way to make more money is to increase the average amount customers spend each time they make a purchase. This can help balance the costs of acquiring new customers and increase your overall profits. To do this, you can try selling more items to customers or offering higher value packages.

In conclusion, customer acquisition cost (CAC) provides a valuable measurement for determining the effectiveness of marketing efforts in terms of generating new business. By calculating the cost of acquiring each new customer, businesses can gain a better understanding of their short-term marketing expenses and long-term customer lifetime value. This information can help organisations optimise their marketing strategies and make more informed decisions to improve return on investment.

The original version of this article can be found on my LinkedIn profile. Please feel free to visit and read it there.

Keep Sharing!

Thanks Kumodini.